- January 13, 2021

- Posted by: Techsol Life Sciences

- Category: Pharmacovigilance

Introduction

Pharmacovigilance is a very important process associated with the gathering, detection, assessment, monitoring and prevention of Adverse Events associated with pharmaceutical products. The immense volume of unstructured information flowing through various channels into the organization also needs to be processed and sent to the relevant Agencies in the prescribed structured format.

As Pharmacovigilance activities are crucial to the pharmaceutical companies, the demand for robust compliance systems and experienced professionals has raised the cost of maintaining the infrastructure needed to support in-house pharmacovigilance activities. So, many companies outsource some of their pharmacovigilance activities to reduce cost and to improve the efficiency of their Pharmacovigilance Systems. Outsourcing the tasks in the Pharmacovigilance processes also provides a flexible solution to the ever-changing demands of the PV team.

Apart from the cost and human resources, the other prominent factors influencing the outsourcing of PV processes are training, technology and changes in regulatory rules.

The Factors Influencing Outsourcing of PV Processes

Now that we have identified the most prominent factors influencing the outsourcing of PV processes, let’s discuss these prominent factors in brief.

Contact us by submitting a business inquiry online. We will get back to you very soon.

Skilled Resources

Finding the right personnel to maintain and operate the PV processes in-house is a tough ask as there is a dearth of talented and dedicated professionals in many geographical locations. Reaching out to the right people, interviewing them, getting them on board and retaining them is an exercise that many firms are not too keen to take up. Companies find it easier to outsource their PV processes to third party vendors who take care of their PV requirements.

Resources who can manage the entire PV process and also adapt to deal with regulatory and compliance requirements are not easy to find. It is not an easy task, especially for large scale organizations due to the number of required employees. Finding the right resources is challenging task in any type of industry and is even more challenging in the Pharma and Lifesciences industries.

Technology

Technology is an area in which every organization is keen to invest in. Firms want in-house processes to take care of their PV needs. However, using the standard tools can limit the organization’s capability to control the business processes. The compliance factor graph too tends to drop if new technology is not utilized to drive the processes. If companies invest in new technology, they have to deal with the additional responsibilities such as finding the right people and defining the processes around the new technology.

Whenever new technology is implemented, it should be done so by using a set of Standard Operating Procedures in order to optimize the performance of the implemented technology. The SOP’s should always be aligned with the regulatory guidelines. Procuring the right technology is one important factor while the main focus should be on whether the new technology will be in sync with other implementations or not. If not, it would become an information silo. A deep learning curve is required for the usage of the technology and it is not an easy task for the daily users to get hands-on experience for the new technology that is implemented.

Training Employees

Training is a very important factor that determines the success of the PV processes implementation. Making the users understand the configurations and usage policy as per the needs of the organization is crucial. Implementing new technology, new processes etc. can only be achieved by training the existing resources as hiring experienced PV resources is challenging.

Cost of In-house PV Processes

One of the biggest factors influencing the outsourcing of PV processes is Cost. The actual cost involved in implementing Technology, Hiring and Training Resources varies based on multiple variables such as the size of the company, number of PV processes being implemented etc. It is now a proven fact that outsourcing PV processes to a specialized vendor is more cost effective.

Changes in Regulatory Rules

Since the introduction of Good PV Practices (GVPs) in the European Union (EU) in 2012, the industry experienced a huge change in the regulatory requirements applicable to PV.

More stringent regulatory requirements including greater reliance on in-market and real-time monitoring made performing compliance related tasks tougher for PV teams. Globalization and national variations in regulatory frameworks too made adherence to the new regulations difficult. Increasing scrutiny of adverse events by regulators is also strong factor in making PV compliance more daunting and difficult.

Given this scenario and looking at a future likely to include additional requirements and increased emphasis on safety data gleaned from social media and industry sponsored websites, outsourcing of PV operations is a viable solution to several companies as the vendors take care of all the regulatory requirements.

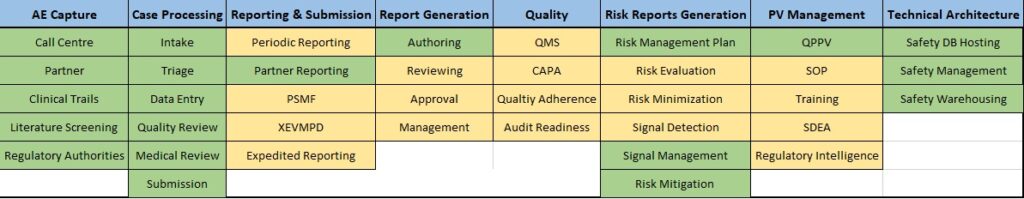

Legend: The above table represents the outsourcing trends of PV Processes.

- Most Commonly Outsourced Processes

- Not So Commonly Outsourced Processes

The Future of PV Outsourcing

As more and more companies outsource their PV functions, the future is shaping up to facilitate end-to-end outsourcing of PV processes and capabilities. We will see the outsourcing of PV processes not just in case processing, aggregate reports or literature views but also in crucial PV areas such as PCVQA, risk management, signal detection etc.

Thought it cannot be a certainty, we can be sure that end-to-end PV process outsourcing will be a reality in the near future. This can be substantiated by the number of companies opting for PV outsourcing and the increasing worth of the PV Outsourcing market. The worldwide market for PV Outsourcing was worth more than $3.8 Billion in 2019 and is estimated to grow at a yearly rate of 15.8% and reach a value of $10.6 Billion by 2026.

Note: The figures mentioned above are as per Global Market Insights, a global Market Research and Consulting Service provider.

– By Sharath Anil

How We Help Sponsors

With over 12+ years of Drug Safety and Pharmacovigilance experience, we provide end-to-end technical and functional services to manage the safety profile of drugs and devices for sponsors.